State of Climate Tech: Trends, Opportunities, and the Path Forward

The climate tech sector stands at a tipping point in 2025. The challenges are mounting: increasing carbon emissions, rising global temperatures, and countries facing more frequent and severe weather events. While solutions are available, their deployment remains a challenge. Capital flows remain inconsistent, regulatory frameworks hinder innovation, and effective solutions face adoption barriers. This demands attention. From startups to multinational corporations, each is asking: how do we accelerate the deployment of climate solutions that work?

The answer requires more than incremental improvement. The development and deployment of climate tech innovations that make a difference require strategic financing, policy interventions, and collaborative action. This blog serves as a blueprint, examining the current state of the climate tech ecosystem, identifying trends shaping its trajectory, and outlining strategies to strengthen it for the future.

State of Climate Tech in 2025

Over time, the climate tech industry has evolved into a leading driver of sustainable growth. Favorable policy environments and rising investor confidence have accelerated momentum, enabling startups to turn innovative ideas into scalable solutions. According to Silicon Valley Bank, U.S. climate tech startups recorded 15% year-on-year growth, attracting $7.6 billion in 2024. The U.K.’s climate tech ecosystem ranks among the best-funded globally, with PwC reporting a 25% surge in investment during the same year.

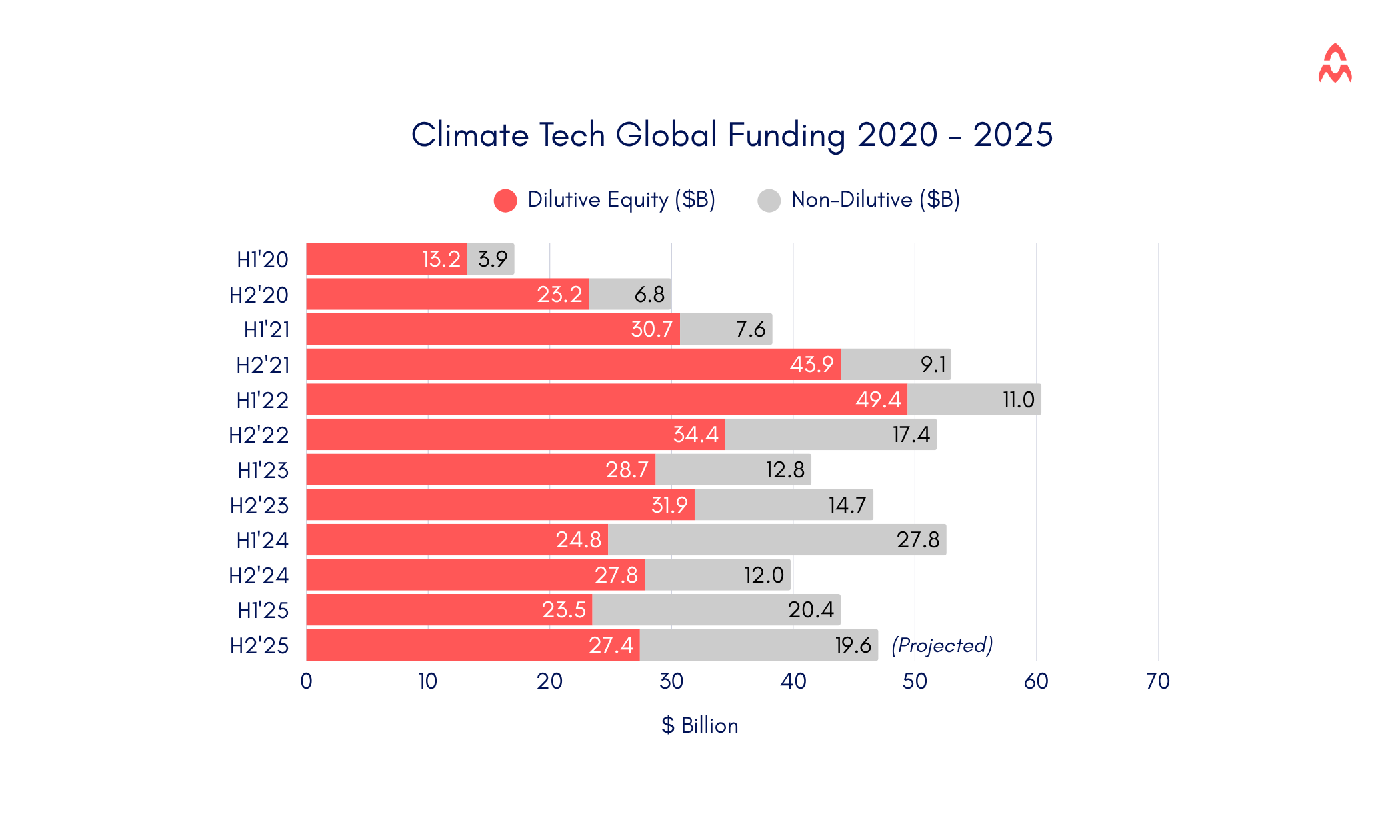

However, the positive sentiment must be balanced alongside the broader challenges facing the industry. According to the market intelligence platform, Net Zero Insights, climate tech secured $23.5 billion in equity funding in the first half of 2025, a 5% decline from 2024, making it one of the lowest half-yearly figures since 2020. Deal volumes also dropped 50% from H1 2024, signalling a shift in funds toward high-value deals in companies focusing on data centre cooling to energy-efficient chip design. However, non-dilutive funding, such as debt and grants, could help the sector rebound in financing by the end of 2025.

The drop in equity funding can be attributed to several factors. Unlike other tech industries, climate tech ventures require substantial capital investment to scale and increase operations. Burhan Pisavadi, an investor at PT1 Ventures, also suggested that funds could be moving to more ‘hyped sectors.’ Moreover, the commercial viability of innovations remains a challenge, aggravated by additional costs such as green premiums (the additional cost of choosing an environmentally friendly technology over a conventional, high-emission one).

The current landscape shows a shift from explosive growth to steady increases, moving towards a more capital-intensive and policy-dependent scale-up phase.

Climate Tech Investment: Key Trends Shaping the Market

The various challenges facing the market have led to a decline in funding and prompted investors to revisit the fundamentals of businesses. Proving unit economics, delivering better value to customers, and considering industry trends, such as advances in AI and renewable energy solutions, are being seen as ways to drive capital back into the climate tech market.

Growing focus on AI and digital solutions: As with other industries, AI technologies are playing an essential role in the climate tech sector. According to Grand View Research, the global AI in environmental sustainability market was valued at $16.55 billion in 2024 and is projected to reach $84.03 billion in 2033, at a CAGR of 19.8%. The UK, in particular, is emerging as the hub for AI-led climate solutions. According to a report by Sustainable Ventures, 9.7% of UK climate tech startups are AI-related, compared to 4.6% across the overall startup landscape. Investors in the country have committed over £800 million to AI-related solutions worldwide, accelerating the sector's growth. Within the industry, autonomous vehicles lead the investment charts, followed by agriculture and energy solutions, IT, and financial services. The pivot signals a significant shift, with investors viewing AI climate tech solutions as a way to address the complexity of environmental challenges and create scalable, financially viable solutions.

Investment in clean power and renewable energy: Globally, investors are looking to invest in clean power and renewable energy solutions. According to the Silicon Valley Bank, in the energy space, clean tech venture capital deals in the US hit a record high of 382 in 2024. This momentum has continued into 2025, not just in the US, but worldwide. According to BloombergNEF, investments in renewable and clean energy totaled $386 billion in the first half of 2025, a 10% increase from the previous year. Despite unfavorable political and economic conditions, growth has accelerated, highlighting that the benefits of long-term investments in the clean energy sector may outweigh short-term uncertainty.

Rising investment in climate adaptation and resilience: Over the years, the impact of climate disasters has become too significant for any government to ignore. According to McKinsey & Company, the first half of 2025 alone saw $162 billion in losses. The severity of the situation has prompted investors and global institutions to fund climate adaptation and resilience technologies that can mitigate its impact, such as platforms that monitor oceans, forests, and risk exposure. In the UK, PwC reported that 28% of climate tech deals focused on addressing climate change challenges, reflecting a growing commitment to strengthening climate resilience worldwide.

Rise in private investment for energy: While recent political and economic events have created uncertainty, prompting investors to adopt a more cautious approach, private investment is playing a major role in the clean energy transition. While institutional investors focus on innovative solutions for sustainability and decarbonization, private investors offer hands-on management and collaboration on aligned objectives. Private investment enables climate tech startups to leverage expertise in corporate governance, operations, and commercial capabilities. Globally, this trend of private investment is steadily rising. Investment group Eurazero has launched a fund to address environmental challenges, including water management and waste reduction. At the same time, Brookfield has partnered with Alterra to launch the Catalytic Transition Fund to scale the impact of clean energy projects in emerging markets.

Non-dilutive capital driving emerging climate technologies: Emerging technologies such as hydrogen, sustainable aviation fuel (SAF), and low-carbon cement are among the fastest-growing innovations receiving public and grant-based funding. A shift that highlights non-dilutive funding’s focus on critical, hard-to-abate sectors. The proposition of capital without equity dilution is ideal for the climate tech sector, where long commercialization cycles are the norm.

Climate Tech Innovations: Solutions Driving Real-World Impact

The momentum within the climate tech ecosystem is translating into tangible outcomes. Across industries, entrepreneurs are moving from experimentation to implementation, transforming prototypes into scalable and market-ready solutions. These climate tech innovations are becoming key enablers of sustainability and climate change mitigation, demonstrating how technology can drive measurable environmental and economic progress.

Digital Technologies: Globally, startups are harnessing digital technologies to accelerate their efforts to reduce the impact of climate change. Climate tech startups are applying tools such as Artificial Intelligence (AI) and the Internet of Things (IoT) to develop scalable solutions. AI is powering smart grids, predicting energy demand, and adjusting supply, while advanced models are also used for climate modeling, forecasting, and carbon capture. IoT technology is being leveraged to gather data and information for real-time monitoring and for energy management. For instance, California-based company PanoAI is using IoT to predict wildfires in the region.

Dexter Energy: Dutch startup Dexter Energy has developed an AI-based software platform that predicts market trends and forecasts energy demand and supply. In July 2025, the company raised €23 million in a Series C investment to accelerate the deployment of its software platform and provide tools that can support local energy companies.

SkySpecs: Based in the United States, SkySpecs is a global climate tech startup leveraging AI to detect and predict faults in wind turbines. By offering automated data analytics and fleet optimization, the company helps reduce maintenance costs and enhance the efficiency of renewable energy systems. In March 2025, SkySpecs secured $20 million in funding to support its global expansion and the development of new technologies.

2. Climate Smart Agriculture: Agriculture has been a significant contributor to climate change. According to Oxfam, it accounts for approximately 25% to 30% of global greenhouse gas emissions. Climate-smart agricultural techniques can significantly mitigate these effects by sustainably increasing productivity, enhancing agrarian resilience, and reducing overall greenhouse gas emissions.

Infarm: Berlin-based startup Infarm is advancing smart agriculture through its concept of modular urban farms. Its technology enables sustainable, local food production by growing crops in compact, controlled environments, significantly reducing waste associated with traditional farming methods. Infarm’s innovative approach to urban agriculture has garnered strong interest from global investors and institutions.

Propagate: Agroforestry is an innovative approach that combines agriculture and forestry to enhance sustainability and is at the forefront of US-based climate tech company Propagate’s operations. They have developed a platform and offer a range of services that make it seamless for farmers to shift to agroforestry. By helping mitigate the effects of challenges such as land degradation and food security, they have positioned themselves as a key player in the industry.

3. Renewable Energy: While renewable energy has long been at the forefront of the fight against climate change, recent years have seen a growing focus on developing long-duration energy solutions. As global demand for renewable power accelerates, the need for reliable and scalable energy storage technologies has become increasingly urgent.

CellCube: Based in the US, CellCube is one of the leaders in developing sustainable and durable energy storage infrastructure. They focus on the production of vanadium redox flow batteries, which in turn facilitate storing energy from sources such as solar and wind, which have fluctuating supplies. In October 2024, they received $19 million from the US Department of Defence to accelerate the deployment of their megawatt-scale vanadium batteries.

Jackery: Jackery is another green technology company that leads the field of portable solar power solutions. They have adopted an innovative approach, developing portable solar panels, generators, and other products that have made renewable and sustainable energy accessible to all.

4. Carbon Capture: To address the growing concentration of CO₂ in the atmosphere, companies and governments are increasingly turning to carbon capture technologies. This process involves capturing emissions from industrial sources and securely storing them underground to prevent their release into the atmosphere. Carbon capture plays a critical role in mitigating climate change and supporting global efforts to meet the targets outlined in the Paris Agreement.

CarbonCapture: Founded in California, US, CarbonCapture has adopted an innovative approach to reducing atmospheric carbon emissions. They have developed specialized machines that not only capture carbon but also produce distilled water from the air. It is a creative solution that can have a substantial impact globally. In September 2025, they raised $400 million in Series C funding, positioning the company at $4.2 billion and making it a significant player in the industry.

CarbonCure: Canadian climate tech company CarbonCure is playing an essential role in reducing carbon emissions from the construction industry, a significant contributor to global emissions. Their technology involves capturing carbon and injecting it into concrete, where it is permanently stored. Their innovation offers many benefits, reducing the construction industry's carbon footprint while strengthening concrete’s composition.

The Future of Climate Tech: What Comes Next

Climate change is a pressing issue, and inaction can lead to devastating consequences that affect every aspect of human life. According to the 2025 Lancet Countdown Report, climate inaction has led to climate-related health issues, including a 23% increase in heat-related mortality since 1990 and 124 million people facing food insecurity due to wildfires and droughts caused by extreme temperatures. Economically, rising temperatures caused productivity losses worth $1.09 trillion in 2024. The Boston Consulting Group further warns that unchecked temperature increases could reduce global economic output by 15% to 34%.

These figures emphasize the critical need to accelerate investing in green technology and strengthen the environmental tech landscape. Yet, economic and political uncertainty continues to make investors cautious. The path forward lies in building a more systematic climate tech ecosystem that enables ideas to scale commercially through collaboration across stakeholders. Entrepreneurial support systems must guide innovators from ideation to implementation, while strategic financing mechanisms ensure consistent capital flow and de-risk investments. Private and public capital will play a pivotal role in driving sustainable growth, underscoring the importance of deeper coordination between the private sector and governments to achieve shared climate objectives. Momentum within the industry is bound to grow. Bloomberg reports that more investors are pouring money into climate tech, while Fortune Business Insights estimates that the industry can grow to $149.27 billion by 2032. However, sustaining this momentum is essential, which will only be possible through support and continuous collaboration amongst all stakeholders to ensure that climate technologies continue to scale and deliver real-world impact.

Partner with us

We are a social impact firm accelerating growth for organizations, governments & universities. Collaborate with Futurize to spearhead entrepreneurship programs, startup incubators, and inclusive innovation strategies to generate groundbreaking ideas and businesses for a sustainable future.